Table of Content

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. She has more than 30 years’ experience as a writer and editor for newspapers, magazines and online publications.

A home equity loan is an unsecured personal loan, so generally that means you can’t take a tax deduction on any interest you paid. One exception is if you can prove to the IRS that you used the home improvement loan to upgrade your home for business purposes. When you take out a home equity loan, the amount you pay for closing costs is typically between 2% and 5% of the loan amount. This means that if you borrow $100,000, your closing costs will likely range between $2,000 and $5,000. Closing costs include things such as the application fee, the appraisal fee, and the cost of the title search.

Buying your first home? Everything to know about mortgage credit certificates

The right choice depends on factors including your financial need and budget. Certain types of finance are not regulated, such as bridging loans. On the other hand, using a home improvement loan will be separate from your existing mortgage and you won’t be paying it off. DIY projects are a bit looser, so they are less dependable for lenders. The quality of work is not as consistent, nor are the timelines – so if DIY is your direction, you want to think of other options than the 203 for the financing.

The helpfulness of a financial advisor's answer is not indicative of future advisor performance. A loan is a binding contract, and most states won’t let you enter into a binding contract unless you are at least 18. If supplies arrive late or your contractor encounters an unexpected issue, your project can stretch on for weeks longer than you anticipated. If you’re renovating a bedroom, it could mean more time in a rental while you wait to move back in. If you borrow against your home equity to renovate your home, you can do pretty much any project you want, but you should consider whether the project will add to your home value.

Find Out What You Qualify For

The home being financed and rehabbed must be at least one year old, and the rehab efforts must be a minimum of $5000. The total value for the property must fall within the FHA mortgage limits for that specific area. There are several advantages of taking a home improvement loan over a remortgage. So, when considering a home improvement loan vs. remortgage, here are some factors to consider. Personal bank loan – If you have no mortgage, not a member of a Credit Union and looking for a small loan. Opinions expressed here are the author’s and/or WalletHub editors'.

For example, the SBA will guarantee up to 75 percent of a $500,000 loan. The guarantee fee of 3 percent would be assessed on the guaranteed portion ($375,000), resulting in a total fee of $11,250. The SBA charges a guarantee fee between 0.25 percent to 3.5 percent of the guaranteed portion of your SBA 7 loan. If you have 100% equity in your home, meaning you own it outright, a home equity loan is not a second mortgage. Fees may be payable depending on your final choice of financial product.

Home Loan vs. mortgage loan

In contrast, you can apply for a home improvement loan and receive a response in a matter of days. Instead, it may begin debt collection, make negative filings on your credit report, and file a lawsuit against you. Marianne Bonner, a certified CPCU and ARM, has covered small business insurance topics for The Balance since 2013. She worked in the insurance industry for 30 years as an analyst and underwriter among other roles and holds multiple professional designations. Along with The Balance, Marianne has written many articles for International Risk Management Institute's Risk Report.

Pay attention to the total amount you would have put into the home after the work is done, relative to an appraiser’s estimate of the total after-project value. Include closing costs, including recording fees, appraisal fees and origination fees. Home equity loans come with fixed interest rates and payment amounts that remain the same for the life of the loan.

Aly J. Yale is a writer and journalist from Houston, specializing in mortgage, real estate, and personal finance topics. Her work has been published in Forbes, The Balance, Bankrate, The Simple Dollar, and more. Once you decide which is best, check out our guides to the best home equity loans and best HELOC rates to start the process.

A home equity loan involves closing costs, while a home improvement loan generally doesn’t. Most home improvement loans have a term of two to five years, but some lenders will provide up to 10 years. Home equity loans typically have a term of five to 20 years but occasionally extend to 30 years.

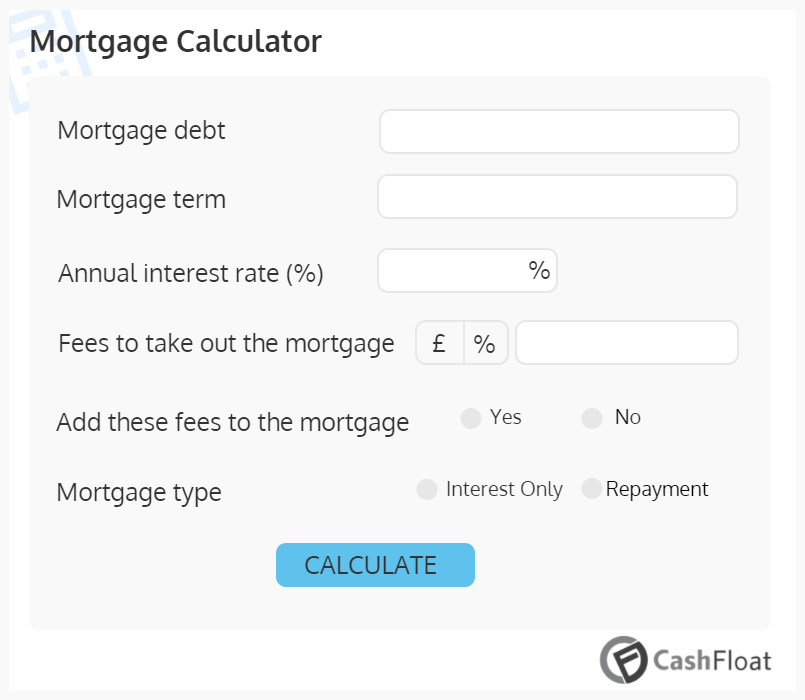

A mortgage calculator can help you determine what effect the size of your down payment will have on your monthly payments. In order to take out a mortgage, you’ll typically need to make a down payment equal to a percentage of the purchase price. Your down payment is the portion of the cost of the home that you aren’t financing and provides immediate equity in the property. As with anything in life, it pays to compare all your options. Compare loan types, rates, and terms carefully to find the best loan for home improvements. FHA 203 rehab loans are great when you’re buying a fixer-upper and know you’ll need funding for home improvement projects right away.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Generally speaking, home equity loans have lower interest rates and longer repayment terms than home improvement loans. For these reasons, a home equity loan may be better for larger home remodels, while a home improvement loan may be the way to go for smaller, lower-cost projects. With a HELOC, you have a “draw period” during which you can make withdrawals from your credit line. Once the draw period ends, you enter a “repayment period,” a period of time during which you must pay back the loan and any accrued interest. HELOCs often have variable interest rates, which means they can fluctuate over the life of the loan. By contrast, most home equity loans come with fixed interest rates.

May feature lower interest rates and shorter repayment terms than conventional improvement loans. If you don’t have enough cash to finance renovations or repairs, a home renovation loan is worth considering. It’s also worth pursuing if you have your eye on a home that has a low asking price but needs serious work. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate.

No comments:

Post a Comment